A Comprehensive Guide to Checking Out the World of Foreclosed Homes in Today's Realty Market

Are you interested in diving into the globe of foreclosed homes? This thorough guide will certainly stroll you via the entire procedure, from recognizing exactly how repossessions work to evaluating the condition of homes - what is the cheapest way to buy a foreclosed home.

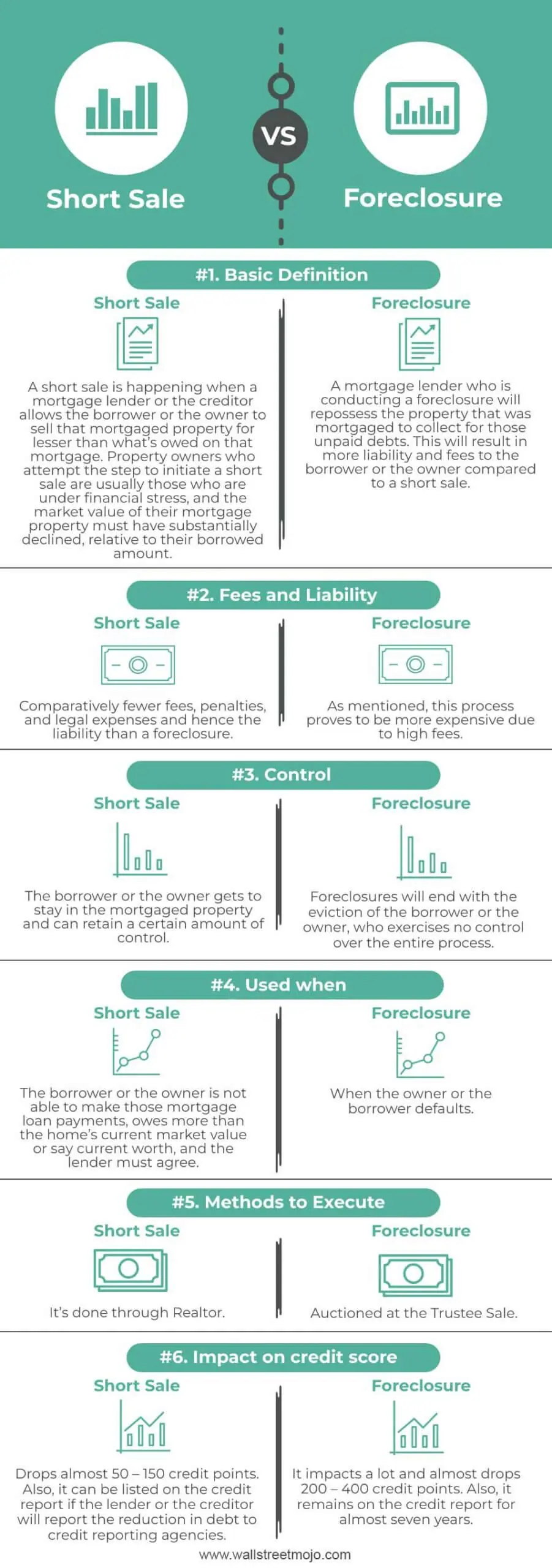

Comprehending the Repossession Process

When a homeowner stops working to make mortgage repayments, the lender has the right to confiscate on the property. The repossession procedure usually starts with the lending institution sending a notification of default to the property owner.

If the home owner does not bring the mortgage current, the loan provider will certainly launch the foreclosure proceedings. This includes submitting a claim against the property owner to take possession of the home. The home owner will after that obtain a notice of foreclosure, stating the day of the foreclosure sale.

On the arranged sale date, the building is auctioned off to the highest bidder. It comes to be recognized as a REO (Real Estate Owned) property and is owned by the lender if the building does not market at auction. Now, the lending institution can note the residential or commercial property available on the market.

Comprehending the repossession process is essential when thinking about purchasing a foreclosed home. It is essential to be familiar with the prospective threats and complications that might develop. Nevertheless, with cautious research study and assistance, buying a seized home can provide an one-of-a-kind possibility to discover a large amount in today's property market.

Looking Into Foreclosed Qualities

When you're researching seized residential properties, it's essential to collect as much information as feasible about the building's history and existing condition. They can supply you with details regarding the repossession process and any type of outstanding financial obligations or liens on the property. By gathering as much information as possible, you can make an informed decision when buying a seized property.

Financing Options for Purchasing Seized Residences

If you're looking to acquire a seized home, there are several funding options offered to aid you protect the necessary funds. Some banks might have stricter needs for foreclosed buildings, so it's crucial to do your study and find a lending institution who specializes in this type of funding. Additionally, you may desire to explore the possibility of an improvement car loan, which can aid cover the costs of repairing and redesigning a foreclosed residential property.

Evaluating the Condition of Seized Feature

Take a close take a look at the general problem of the foreclosed homes you're taking into consideration to guarantee you're aware of any type of needed fixings or remodellings. When it pertains to getting a confiscated home, it's crucial to thoroughly assess its condition before making a choice. Beginning by carrying out a comprehensive inspection of the residential click here for more info property. Search for any indicators of damages, such as water leaks, structural problems, or electrical problems. Check the roof, foundation, pipes, and electric systems to guarantee they are in good working order. Do not neglect to check out the inside also, including the floorings, home appliances, and walls. It's vital to determine the level of repair services or restorations required and consider the costs related to them. Working with an expert inspector can give you with a thorough report, aiding you make an educated decision. foreclosed homes for sale cheap. In addition, think about connecting to specialists or service providers who can approximate the expense of repairs. Keep in mind to consist of these costs in your budget and discuss the acquisition rate as necessary. By reviewing the condition of seized properties, you can prevent unexpected shocks site and make a well-informed financial investment choice.

Navigating the Bidding and Buying Process

Navigating the bidding and acquiring procedure can be challenging, however with cautious study and prep work, you can increase your possibilities of safeguarding a foreclosed home. Take into consideration acquiring a bank-owned home straight from the lending institution or working with a real estate agent that specializes in repossessions. Remember, patience and persistence are essential when it comes to getting a seized building.

Verdict

If the building does not offer at auction, it comes to be recognized as a REO (Actual Estate Owned) residential property and is had by the lender. With cautious research and support, purchasing a confiscated home can offer an one-of-a-kind opportunity to locate a terrific bargain in today's real estate market.

Acquiring and navigating the bidding procedure can be challenging, however with mindful research and prep work, you can increase your possibilities of safeguarding a foreclosed residential property.